Alpaca Day Trading provides traders with a unique opportunity to engage in fast-paced market activities, leveraging advanced tools and techniques to capitalize on short-term price movements. In this comprehensive guide, we’ll explore everything you need to know about mastering Alpaca Day Trading, from the basics of day trading to advanced strategies and risk management techniques.

Introduction to Alpaca Day Trading

A. Definition and Overview

Alpaca Day Trading involves buying and selling financial assets within the same trading day, aiming to profit from short-term price fluctuations.

B. Importance in the Financial Markets

Day trading plays a crucial role in providing liquidity to the markets and facilitating efficient price discovery. It also offers individuals the opportunity to generate income through active trading.

Understanding Day Trading

A. Definition and Concept

Day trading refers to the practice of buying and selling financial instruments, such as stocks or cryptocurrencies, within a single trading day to profit from intraday price movements.

B. Key Principles and Strategies

Successful day trading requires understanding key principles such as technical analysis, fundamental analysis, and risk management. Traders employ various strategies, including scalping, momentum trading, and range trading, to capitalize on short-term opportunities.

Introducing Alpaca: A Revolutionary Trading Platform

A. Overview of Alpaca

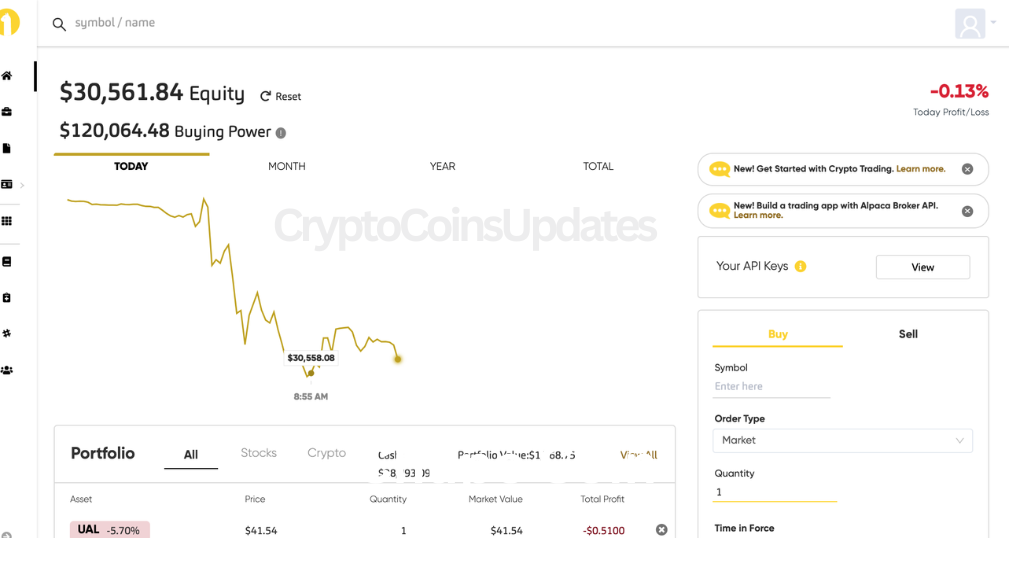

Alpaca is a commission-free trading platform that provides traders with access to the financial markets, including stocks, cryptocurrencies, and ETFs. It offers advanced trading tools, real-time data, and seamless integration with trading algorithms.

B. Features and Benefits

Alpaca’s features include a user-friendly interface, customizable trading dashboards, and API access for algorithmic trading. It also offers low-latency execution and competitive pricing, making it a preferred choice for day traders.

Getting Started with Alpaca Day Trading

A. Account Setup and Registration

To begin day trading on Alpaca, traders need to create an account and complete the registration process. This involves providing personal information, verifying identity, and funding the trading account.

B. Platform Navigation and Interface

Once registered, traders can navigate Alpaca’s platform to access various trading features, including order placement, charting tools, and account management functions. The intuitive interface makes it easy for traders to execute trades and monitor market activity.

Technical Analysis Techniques for Day Trading

A. Candlestick Patterns

Candlestick patterns are graphical representations of price movements over a specific time period. Traders use candlestick patterns to identify potential trend reversals, continuation patterns, and entry/exit points for trades.

B. Moving Averages

Moving averages are trend-following indicators that smooth out price data to identify the underlying trend direction. Traders often use moving averages to confirm trends, identify support and resistance levels, and generate trading signals.

Fundamental Analysis in Day Trading

A. Market News and Events

Fundamental analysis involves analyzing economic data, corporate earnings reports, and other market news and events to assess the intrinsic value of an asset. Traders use fundamental analysis to identify catalysts that may impact price movements.

B. Economic Indicators

Key economic indicators, such as GDP growth, unemployment rates, and inflation data, provide insights into the health of the economy and potential market trends. Traders monitor economic indicators to anticipate market movements and adjust their trading strategies accordingly.

Risk Management Strategies for Alpaca Day Traders

A. Stop Loss Orders

Stop-loss orders are risk management tools that allow traders to limit potential losses by automatically exiting a trade if the price moves against them beyond a predetermined level. Traders use stop loss orders to protect capital and minimize downside risk.

B. Position Sizing

Position sizing involves determining the appropriate amount of capital to allocate to each trade based on risk tolerance and account size. Traders use position sizing strategies to manage risk and optimize returns while maintaining a consistent risk-reward ratio.

Developing a Day Trading Plan with Alpaca

A. Setting Goals and Objectives

Before entering trades, traders should establish clear goals and objectives, such as profit targets, risk tolerance levels, and trading frequency. A well-defined trading plan helps traders stay disciplined and focused on achieving their financial goals.

B. Creating a Trading Routine

Consistency is key to successful day trading. Traders should develop a daily trading routine that includes pre-market preparation, trade execution, and post-market analysis. A structured trading routine helps traders maintain discipline and adapt to changing market conditions.

Choosing the Right Assets for Day Trading on Alpaca

A. Stocks

Alpaca offers access to a wide range of stocks listed on major exchanges, allowing traders to choose from various sectors and industries. Traders should focus on liquid stocks with high trading volume and volatility for optimal day trading opportunities.

B. Cryptocurrencies

In addition to stocks, Alpaca also supports cryptocurrency trading, offering access to popular digital assets such as Bitcoin, Ethereum, and Litecoin. Cryptocurrency day traders can take advantage of the 24/7 nature of the crypto markets and high volatility to capitalize on intraday price movements.

Advanced Trading Techniques with Alpaca

A. Scalping

Scalping is a high-frequency trading strategy that involves entering and exiting trades rapidly to profit from small price movements. Traders use scalping techniques such as tape reading, order flow analysis, and level 2 data to execute quick trades and capitalize on short-term market inefficiencies.

B. Breakout Trading

Breakout trading is a momentum-based strategy that involves entering trades when the price breaks above or below a predefined support or resistance level. Traders use breakout patterns and volume analysis to identify potential breakout opportunities and ride the momentum for profit.

Backtesting Strategies with Alpaca

A. Historical Data Analysis

Backtesting involves analyzing historical market data to test the performance of trading strategies under different market conditions. Traders use backtesting tools and software to simulate trades and evaluate strategy profitability, risk-adjusted returns, and performance metrics.

B. Performance Evaluation

After backtesting, traders evaluate the performance of their strategies based on key metrics such as profitability, win rate, maximum drawdown, and Sharpe ratio. Performance evaluation helps traders identify strengths and weaknesses in their trading strategies and make necessary adjustments for improved results.

Utilizing Alpaca’s API for Automated Trading

A. Introduction to API Trading

Alpaca’s API (Application Programming Interface) allows traders to automate their trading strategies and execute trades programmatically. API trading enables advanced order types, algorithmic trading, and real-time data integration, providing traders with greater flexibility and efficiency in executing trades.

B. Building and Deploying Trading Algorithms

Traders can use programming languages such as Python or JavaScript to develop custom trading algorithms that interface with Alpaca’s API. By leveraging algorithmic trading strategies such as mean reversion, trend following, and statistical arbitrage, traders can automate their trading process and take advantage of market opportunities without manual intervention.

Tips for Success in Alpaca Day Trading

A. Patience and Discipline

Successful day trading requires patience and discipline. Traders should avoid impulsive decisions and stick to their trading plan, even during periods of market volatility. By staying disciplined and patient, traders can avoid emotional trading and make rational decisions based on market analysis.

B. Continuous Learning and Adaptation

The financial markets are constantly evolving, and successful traders must continuously educate themselves and adapt to changing market conditions. Traders should stay updated on market news and trends, learn from both successes and failures, and adjust their trading strategies accordingly to stay ahead of the curve.

Common Mistakes to Avoid in Alpaca Day Trading

A. Overtrading

Overtrading occurs when traders execute too many trades in a short period, leading to increased transaction costs, overexposure to risk, and diminished returns. Traders should focus on quality over quantity and only trade when there are clear and favorable opportunities in the market.

B. Ignoring Risk Management

Risk management is essential for preserving capital and avoiding catastrophic losses in day trading. Traders should always use stop-loss orders, manage position sizes, and diversify their trading portfolio to mitigate risk and protect against adverse market movements.

Tax Implications of Alpaca Day Trading

A. Reporting Requirements

Traders are required to report their trading activities and capital gains/losses to the relevant tax authorities. Depending on the jurisdiction, traders may need to file various tax forms, such as Form 8949 and Schedule D in the United States, to report their trading income and losses.

B. Taxation of Trading Gains

The taxation of trading gains depends on various factors, including the holding period of the assets, the trader’s tax status, and the tax laws of the jurisdiction. Short-term capital gains, which result from assets held for less than one year, are typically taxed at higher rates than long-term capital gains, which result from assets held for more than one year.

Monitoring Performance and Tracking Progress

A. Journaling Trades

Keeping a detailed trading journal is essential for tracking performance, analyzing trading patterns, and identifying areas for improvement. Traders should record information such as entry/exit points, trade duration, position sizes, and the rationale behind each trade to gain valuable insights into their trading behavior.

B. Reviewing Performance Metrics

Traders should regularly review key performance metrics such as profitability, win rate, average gain/loss, and maximum drawdown to assess their trading performance objectively. By analyzing performance metrics, traders can identify strengths and weaknesses in their trading strategies and make necessary adjustments to improve their overall profitability.

Alpaca Community and Support Resources

A. Online Forums and Communities

Alpaca provides access to online forums, communities, and social media channels where traders can connect with fellow traders, share insights, and discuss trading strategies. Engaging with the Alpaca community allows traders to learn from others’ experiences, exchange ideas, and stay updated on the latest market trends.

B. Customer Support Channels

Alpaca offers customer support services, including live chat, email support, and knowledge base articles, to assist traders with any platform-related questions or issues. Traders can reach out to Alpaca’s customer support team for assistance with account setup, technical problems, or general inquiries.

Regulatory Considerations for Alpaca Day Traders

A. Compliance Requirements

Day traders must comply with applicable regulatory requirements, including Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, to ensure legal and regulatory compliance. Traders should familiarize themselves with the regulatory framework governing their trading activities and adhere to all relevant laws and regulations.

B. Regulatory Oversight

Alpaca operates under the regulatory oversight of relevant financial authorities, such as the Securities and Exchange Commission (SEC) in the United States. Traders should be aware of the regulatory environment in their jurisdiction and ensure that their trading activities comply with all applicable laws and regulations to avoid potential legal and financial consequences.

The Future of Alpaca Day Trading

A. Advancements in Technology

As technology continues to evolve, Alpaca is likely to introduce new features and enhancements to improve the trading experience for users. Traders can expect advancements in areas such as artificial intelligence, machine learning, and automation, which may further optimize trading strategies and increase efficiency.

B. Potential Market Developments

The financial markets are subject to constant change, driven by factors such as economic trends, geopolitical events, and technological innovations. Traders should stay informed about market developments and anticipate potential shifts in market dynamics to adapt their trading strategies and capitalize on emerging opportunities.

Conclusion: Mastering the Art of Day Trading with Alpaca

In conclusion, Alpaca Day Trading offers traders a powerful platform and tools to engage in fast-paced market activities, capitalize on short-term price movements, and achieve their financial goals. By understanding the principles of day trading, utilizing advanced trading techniques, and adhering to risk management practices, traders can master the art of day trading with Alpaca and navigate the financial markets with confidence and success.